brembo ブレンボ ブレーキローター 1台分セット マークIIクオリス MCV20W MCV21W H11.8~H13.12

(税込) 送料込み

商品の説明

商品説明

車メーカー TOYOTA

トヨタ車種 MARK II QUALIS

マークIIクオリス型式 MCV20W MCV21W 年式 H11.8~H13.12 (1999/08~2001/12)

メーカー品番 09.A386.10 / 08.5625.20 商品名 ブレーキローター

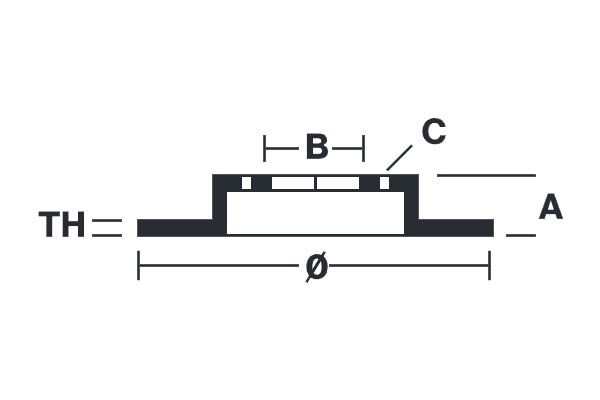

フロント リア 直径 275mm 269mm 厚さ (TH) 28mm 10mm 高さ (A) 49mm 65mm 穴数 (C) 5 5 ブレーキディスクのタイプ 換気 ソリッド センタリング (B) 62mm 62mm 最小厚さ 26mm 9mm 締め付けトルク 103Nm 103Nm 車軸 フロント リア 1箱あたりの個数 2 2 EANコード 8020584016244 8020584562529

商品説明 高性能車からフィードバックされ、新たに幅広い車種に対応すべく研究し生まれた純正品質の補修用ブレーキディスクです。

自社工場での生産、これまでのノウハウを活かした部品設計、それらを最先端技術の活用で開発・生産されることで、コストパフォーマンスを追求しています。

純正の感覚に非常に近く、高性能を実現させたブレーキディスクとなります。

ブレンボは、レースカーや高級車などのハイエンド車でブレーキシステムにおいてはトップブランドとして存在しています。

世界で認められたブレーキシステムの技術力は他社とは比べ物にならない性能レベルを実現しています。

F1を始めとする世界のレースでも採用され、日本の自動車メーカーも純正部品として採用しており、商品の性能だけではなく安心と信頼も提供しています。

詳細は、こちらの国内代理店HPをご確認ください。

注意事項 ※一度、メーカーで受注するとキャンセル・商品変更ができません。

※商品写真はサンプルです。実際の商品とは色・形状が異なります。

※ブレーキシステムは重要保安部品です。分解・整備は認証工場または整備工場で行ってください。

※製品の仕様や価格の変更、製造及び販売を予告無く中止する場合がございます。

※車種別に専用設計品の為、適合車種の情報に全て一致しなければ装着できません。

※本製品は純正品と交換するタイプとなります。

※ブレーキパーツは適合が複雑な為、必ずホームページ適合表を参照の上適合確認してください。

※国産車の場合は「型式」「年式」「車体番号」「類別区分番号」「型式指定番号」「純正品番」を記載しお問合せください。

※掲載の情報はデータ作成時の情報を元に掲載しています、「車両情報」「商品詳細」「品番」など更新されている場合もございます。

ご注文前にはお客様ご自身でご確認をお願い申し上げます。

事前に適合確認を無しでの購入で適合しなかった場合返品には応じられません。

※初期不良以外の返品交換には応じられません。

※お客様の見落としや確認ミスでのキャンセル・交換・返品は一切お受けできません。

納期について こちらの商品はお取り寄せになります。

メーカー在庫あれば1~2日後出荷、メーカー在庫切れの場合は海外生産の為、1ヶ月~数ヶ月お時間を頂く場合もございます。

お急ぎの場合はご注文前に必ず在庫確認をお願い致します。

納期が遅い等によるキャンセルは一切お受けできません。

ご注文前のご確認お支払い、お届け、取扱商品などの詳細につきましては、「お買い物ガイド」をご確認ください。

※落札前に必ず納期・在庫及び適合確認をして下さい。

※事前確認のない注文のキャンセルや変更や交換や返品はお受けできません(納期がかかる場合でも)

※落札後の変更などはできませんのでご了承下さい。

※弊社より連絡がない場合は必ず自己紹介をご確認下さい。

長期休暇、臨時休暇などその他注意事項を記載しております。

| ご注文について |

|---|

| お客様からのご注文は24時間受け付けております。メールやご質問の返答等は、営業時間にのみ行っております。当社営業カレンダーをご確認ください。 商品には、在庫品とお取り寄せ品がありますので、在庫状況によっては、お時間をいただく場合もございます。また、店頭での販売、他ネットショップでも販売しておりますので、売り切れの場合はキャンセルとさせていただきます。予めご了承ください。 お取寄せ商品の中には、メーカーで製造廃止となり、在庫もない場合がございます。この場合はキャンセルとさせていただきますので予めご了承ください。 |

| お支払いについて |

| 銀行振込ができます。 PayPay銀行(旧ジャパンネット銀行) ゆうちょ振替 (振込み手数料はご負担願います) クレジット決済ができます。 ※上のいずれかのクレジットカードでお支払いになると、お客様のクレジットカード番号はご注文先ストアを経由せず、カード会社に安全に送信されるため安心です。 (※ご請求時期についてはご利用の各カード会社にお問い合わせください。) PayPay残高払いができます。 「PayPay残高払い」はPayPay株式会社が提供するスマートフォンを使ってお支払いができる電子マネーサービスです。 |

| 送料について |

| 北海道・沖縄・離島や、複数ご注文の場合につきましては、送料の変更が必要となる場合がございます。落札後に改めてご案内させていただきます。 その他、メーカー直送の商品は、送料が別途必要となる場合があります。 発送は、「ゆうパック」「ヤマト運輸」「佐川急便」「西濃運輸」で出荷いたします。 (※配送会社は選択できません。地域、荷物の大きさによって変わります) |

| 商品画像について |

| 商品画像はメーカーイメージ及び共通使用画像となります、画像と現物・色合いなどが異なる場合があります。 |

| 返品について |

| お客様都合による商品返品交換は、いかなる理由でもお受けできません。(サイズ違い・色違い・思い違い・納期が遅い 等) ※不具合・初期不良がございましたら商品到着5日以内にご連絡ください。納品書、送り状控え・保証書のないものはご返品交換お受けできません。 弊社に要因がある場合は、速やかに対応させていただきます。(商品の発送ミス、数量不足、等) 不良発生時における弊社の保証範囲は製品本体の交換のみに限られます。 製品の取り付け、取り外しに伴う作業工賃、部品代、代車代などは、弊社では保証しかねますので、あらかじめご了承ください。 |

| プライバシーについて |

| お客様の個人情報は、商品の発送・弊社からの各ご案内以外の目的には使用いたしません、但し、法的機関(警察、裁判所等)より情報の開示を求められた場合は、上記の限りではございません。 重要事項のご記入についてはSSLという暗号化され送信されるシステムを使用しております。 |

| その他 |

| お問い合わせについて 商品について不明な点や、在庫状況、納期につきましては、商品ページの「お問合わせ」 からご質問ください。順次、回答させていただきます お願い メールアドレスを携帯電話に設定中のお客様へ ドメイン指定を解除して、PCからのメールを受信できる状態にしておいてください。 株式会社オートクラフト 〒528-0054 滋賀県甲賀市水口町酒人1020-1 定休日:日曜日 配送業務のみ:土曜日 営業時間:AM10:00~PM7:00 古物商 [水第265号 交付60年6月14日 滋賀県公安委員会 株式会社オートクラフト] |

楽天市場】brembo ブレンボ ブレーキローター リア用 マークIIクオリス

楽天市場】bremboブレーキディスクローターF用MCV20W/MCV21WマークII

楽天市場】bremboブレーキディスクローターF用MCV20W/MCV21WマークII

楽天市場】brembo ブレーキローター 左右セット TOYOTA マークII

楽天市場】brembo ブレンボ ブレーキローター リア用 マークIIクオリス

楽天市場】bremboブレーキディスクローターF用MCV20W/MCV21WマークII

楽天市場】brembo ブレーキローター 左右セット TOYOTA マークII

楽天市場】bremboブレーキディスクローターF用MCV20W/MCV21WマークII

楽天市場】brembo ブレンボ ブレーキローター リア用 マークIIクオリス

【楽天市場】bremboブレーキディスクローターF用MCV20W

brembo ブレーキローター 左右セット TOYOTA マークII クォリス(ワゴン) MCV25W SXV25W 97/04〜01/12 リア 08.A150.10 | ゼンリンドライバーズステーション

ヤフオク! -「2ピースローター」(ブレーキローター) (トヨタ用)の落札

車用ブレーキ マーク2クオリスの人気商品・通販・価格比較 - 価格.com

楽天市場】bremboブレーキディスクローターF用MCV20W/MCV21WマークII

車用ブレーキ マーク2クオリスの人気商品・通販・価格比較 - 価格.com

車用ブレーキ マーク2クオリスの人気商品・通販・価格比較 - 価格.com

2023年最新】Yahoo!オークション -ブレンボ ブレーキ クラウンの中古品

2023年最新】Yahoo!オークション -ブレンボ ブレーキ クラウンの中古品

車用ブレーキ マーク2クオリスの人気商品・通販・価格比較 - 価格.com

車用ブレーキ マーク2クオリスの人気商品・通販・価格比較 - 価格.com

楽天市場】bremboブレーキディスクローターF用MCV20W/MCV21WマークII

楽天市場】brembo ブレーキローター 左右セット TOYOTA マークII

ブレーキ クラウン 車 ブレンボの人気商品・通販・価格比較 - 価格.com

フロント Brembo 6Pot Type-R 380φ クラウンMAJESTA GWS214 | Biot

2023年最新】Yahoo!オークション -ウィンダム mcv20(パーツ)の中古品

brembo 純正互換ブレーキローター のパーツレビュー | MiTo(しょーた

車用ブレーキ ブレーキパッド エンドレス sssの人気商品・通販・価格

2023年最新】ヤフオク! -カムリ sxv20(自動車、オートバイ)の中古品

車用ブレーキ ブレーキパッド エンドレス sssの人気商品・通販・価格

ブレンボ ブレーキローターの値段と価格推移は?|67件の売買データ

2023年最新】Yahoo!オークション -ブレンボ ブレーキ クラウンの中古品

ヤフオク! -「ブレンボ」(ブレーキキャリパー) (レクサス用)の落札相場

![Webike | Brembo ブレンボ [Groove] グルーヴ フローティングディスク](https://img.webike-cdn.net/catalogue/webike_images/0000/0000/0304/24901615_20220624150021694.jpg)

Webike | Brembo ブレンボ [Groove] グルーヴ フローティングディスク

ブレンボ ブレーキローターの値段と価格推移は?|67件の売買データ

![Webike | Brembo ブレンボ [Groove] グルーヴ フローティングディスク](https://img.webike-cdn.net/catalogue/webike_images/0000/0000/0304/24901615_20220624150021704.jpg)

Webike | Brembo ブレンボ [Groove] グルーヴ フローティングディスク

2023年最新】Yahoo!オークション -ブレンボ ブレーキ クラウンの中古品

![Webike | Brembo ブレンボ [Groove] グルーヴ フローティングディスク](https://img.webike-cdn.net/catalogue/webike_images/0000/0000/0304/24901615_20220624150021684.jpg)

Webike | Brembo ブレンボ [Groove] グルーヴ フローティングディスク

ブレンボキャリパーの値段と価格推移は?|237件の売買データから

車用ブレーキ ブレーキパッド エンドレス sssの人気商品・通販・価格

ブレンボ ブレーキローターの値段と価格推移は?|67件の売買データ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています